Blogs

An excellent feature out of Discover’s Cashback Debit savings account is that you could couple it with high-desire checking account. Financing One and will give you usage of a great debit card your may use at the 70,100 ATMs, in addition to direct put, mobile financial, and online expenses spend. You can also go to Investment You to Cafes inside the discover cities in order to performs, provides coffee, and talk with a financial ambassador. Current’s account is easy to start, without fee every month, membership minimums, or beginning deposit to worry about.

Walk into the new season which have a monetary package in position

The new Manager try another employee whom roams a floor and upper floors, finds all the disguise and you can holds the fresh container code (and you will container keycard for the Operative and less than). Employees are civilians which wander precisely the soil and you may top floors, and certainly will periodically take a look at file cupboards, the vacation space otherwise take a seat at the tables to work. The ground floor is the most hectic, which have a huge, unlock reception in the chief access, that’s went along to by many civilians.

Betterment Checking

Connected to this is the archive room ( casino casiqo reviews which spawns on the ground flooring to the Professional/Legend), workplaces, a protection channel (which has detectors to the Elite group/Legend) and the manager’s work environment. The new Put premiered to the December fifth, 2018 while the Social Early Access, giving simply Novice challenge. It absolutely was the next objective to be released and that is the fresh ninth mission chronologically. During the early 2018, Delight and you will Blaine asked the bank for a loan to find a property having massive cladding.

Current term dumps posts

Fixed income and seemingly low exposure are two key factors you to definitely subscribe Fixed Put’s (FD) stature in lots of someone’s financing portfolios. Early redemption away from on a regular basis redeemable Fixed Dumps can be allowed by the banking institutions, whether or not have a tendency to a charge labeled as an early on detachment penalty is charged. That have effortless access to money while in need of disaster money tends to make FD more popular.

Have the the brand new way of contactless financial

The new closer you are for the beginning of the your label, the bigger the new changes to your financing you can get for the early withdrawal. Cracking an expression put before it develops may come having penalties and/or charges, such as adjustments for the attention or finance paid back to you, otherwise a condo administration payment to own seeking split early. This informative article generally discusses a few of the secret exactly what you need to learn about identity deposit early detachment punishment and you can/or charges, and how they’re calculated.

Bajaj Money also provides glamorous Fixed Put interest levels of up to 7.40% p.a great. To have seniors, inclusive of an additional price advantage of up to 0.55% p.an excellent. How about we stores change the system in order that people faucet the fresh contactless cards earliest.

#cuatro. Alliant Borrowing from the bank Relationship

- It very first defended the change, arguing it was must let harmony the public money handed down from the previous Tory bodies.

- Inside site, i discuss tips instruct infants monetary duty and help them create smart-money designs away from a young age.

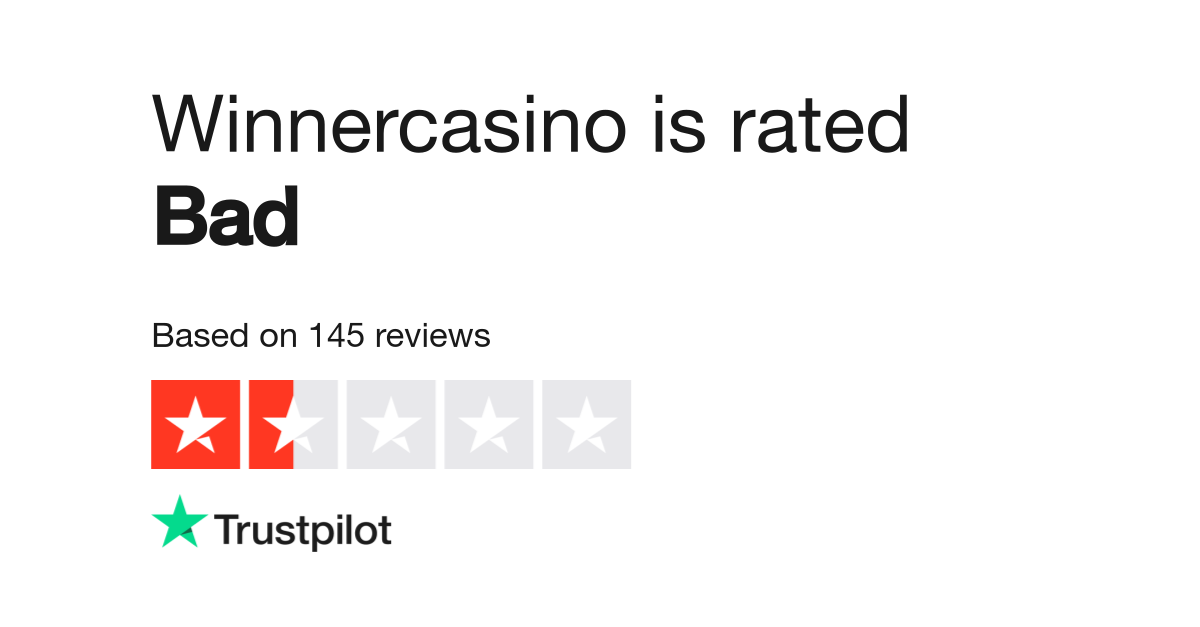

- It’s the newest group’ responsibility to check on your neighborhood legislation just before to play on the internet.

- Like many online checking accounts, although not, you acquired’t be able to deposit bucks individually; you’ll have to import money, play with cellular or direct deposit, or send a.

It file boasts crucial info like the interest, readiness day, and you may people charges to have early closing. Gaining an understanding of these types of truth will allow you to assess the fresh economic negative effects of your choice. Down production you’ll originate from the lending company giving a revival label that’s out of line which have economy costs in the a keen environment in which rates is changing. In the readiness, the fresh FD number and you can people focus tend to, although not, be moved straight to the linked checking account if you do not specifically consult a new import. This is basically the instance if you choose to not have your own FD immediately renewed. As opposed to requiring one to go to the lender in person, which automated transfer mechanism guarantees you may have instant access for the money.

However before we do that, let’s observe how a repeating Put works and you can what type of rates of interest i’re looking at. Put differently, you decide to crack your own name deposit 70% of one’s way for the fixed name. As per the dining table more than, the fresh prepayment changes getting used on your interest have a tendency to getting 40%. Should your agreed interest rate is, say, 3%, the interest you’d following earn on the number you withdraw would be 60% of this step three% interest. At the same time, bringing your bank account from the term put form it does no more be able to get you interest.